Form 1120 pol is an annual information return typically filed by political in certain tax-exempt organizations electronically to e-file form 1120 pol click 990 series and choose form 1120 pols under start new forms in the dashboard of your account your initial step is to select your organization from the address book or add new organization details verify and edit the details of the organization if necessary then click Next to proceed next choose the tax year based on the organization's accounting period then specify if the business had any taxable income for 2017 the 1120 pol form is filed only if the political orgasm organization has any political income next specify whether the organization is a 527 organization 501 C organization or other type of organization and pr the date when the organization was formed review the summary of your organization details displayed below make sure the details are accurate before moving forward in the e-filing process the below diagram is an overview of our filing process you will be guided through various questions where you can input your tax data to get started click begin select the section you want to complete of the 1120 pol in the income section you must pr the revenues earned by the organization for the current tax year click the options start to fill each revenue category specify the details of each section before starting the remaining ones tax pandas will walk you through each section of the e-filing process simplifying each category into a series of basic questions during the e-filing process TXT bandits will prey tax summary where you can then input your payment option for the estimated tax and payments through electronic funds withdraw or FTPS please note form 88 68 is an application for filing an extension of...

Award-winning PDF software

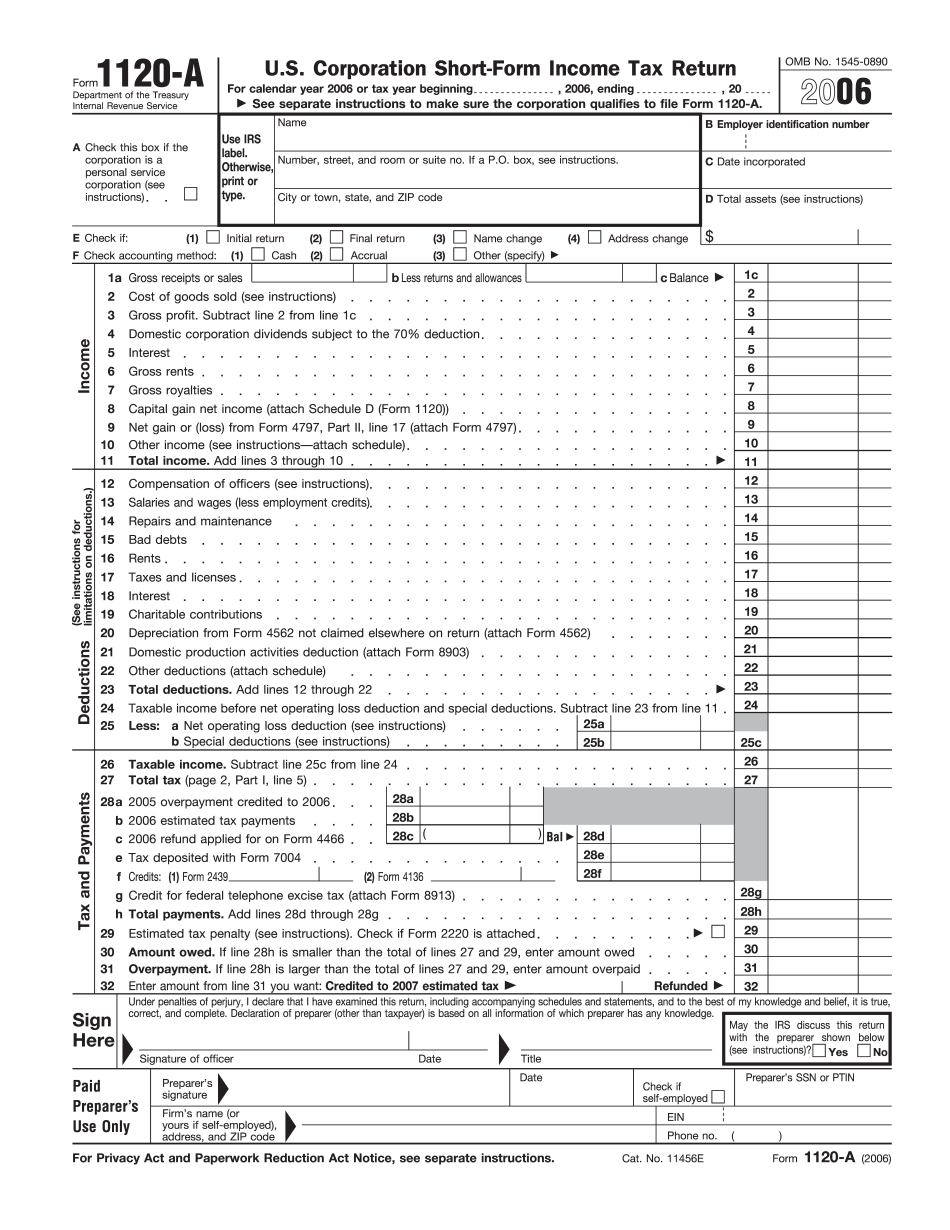

How to prepare FoRm 1120-A

What Is FoRm 1120-A

Online solutions allow you to arrange your file management and raise the productiveness of the workflow. Observe the brief guide so that you can complete Irs FoRm 1120-A, prevent errors and furnish it in a timely manner:

How to fill out a FoRm 1120-A on the web:

-

On the website with the blank, press Start Now and go towards the editor.

-

Use the clues to complete the suitable fields.

-

Include your personal information and contact details.

-

Make absolutely sure that you enter suitable information and numbers in suitable fields.

-

Carefully check out the data in the document as well as grammar and spelling.

-

Refer to Help section when you have any concerns or address our Support team.

-

Put an digital signature on your FoRm 1120-A printable with the support of Sign Tool.

-

Once document is completed, press Done.

-

Distribute the prepared via electronic mail or fax, print it out or save on your device.

PDF editor makes it possible for you to make adjustments to your FoRm 1120-A Fill Online from any internet connected gadget, customize it based on your requirements, sign it electronically and distribute in different approaches.

Things to know about FoRm 1120-A

What people say about us

Become independent with electronic forms

Video instructions and help with filling out and completing FoRm 1120-A