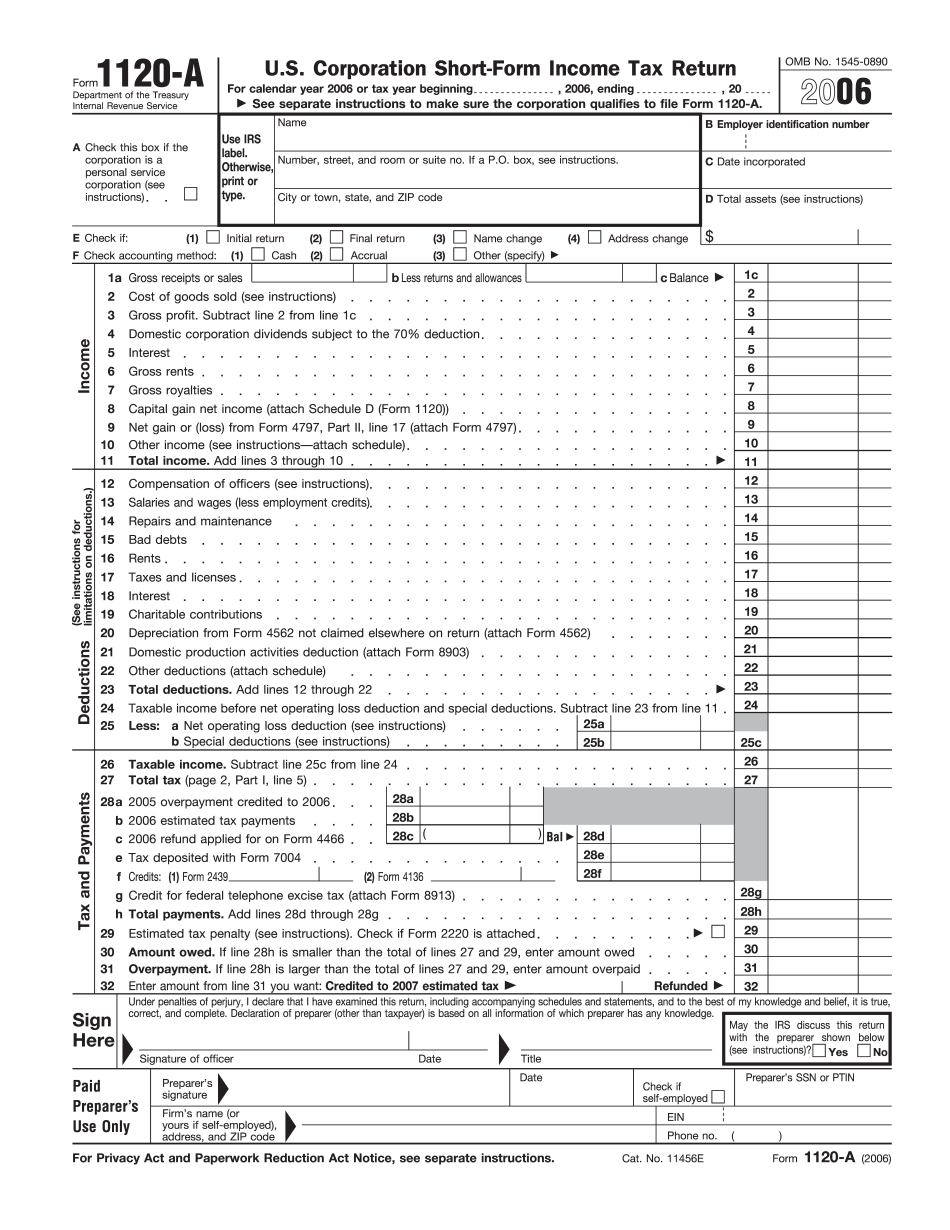

FoRm 1120-A and Form 1120: Basics

Form 1120-S: U.S. Income Tax Return for an S Corporation Definition

Shareholders of S corporation generally must file their return on paper by the due date for their filing period (including extensions of up to 45 days) or on an online return by the due date (including extensions of up to 45 days), unless an earlier filing date has been specified between the due date and actual filing date. A separate form is required for each tax year for which an S corporation income tax return is required. A tax return is not required for the initial period if the period has been active. Once a new return is received, it must be filed by the due date. See IRM 21.5.1.7, Annual Report and Tax Return Preparation Guide for Form 1120-S, and IRM 21.16.6.9, Application for Return to the IRS. You must include the return for any period in which the corporation is active, even though the return was not received until a later date. See IRC 6672(b)(7)(R)(7). The requirements listed below are limited due to the fact that the information that will be used for computing the corporation's gross income is generally available prior to and throughout the filing of the return. However, the tax year in which the return is filed is determined by the due date. Therefore, if you use Form 8453 to obtain information prior to or throughout the Form 1120-S for the corporation, then the information will normally be available on Form 8453 for the corporation tax year during which the return is filed. However, this is not necessarily the case. The information that will be used for computing the corporation's gross income is generally available prior to and throughout the filing of the return. However, the tax year in which the return is filed is determined by the due date. Therefore, if you use Form 8453 to obtain information prior to or throughout the Form 1120-S for the corporation, then the information will normally be available on Form 8453 for the corporation tax year during which the return is filed. You may use Form 1120-S to file Schedule C (Form 1040). If the return has not yet been filed, you may use Form 1120-S to report the net income for the period. See section 6041(b)(3). For more information, see IRM 21.17.2, Net Income on S Corporation Returns and Form 1120-S. To determine an applicable rate for Form 1120-S, use Form 1120-S:

Form 1120-S: U.S. Income Tax Return for an S Corporation Definition

This form is sent to the Internal Revenue Service (IRS). These schedules can be used to: determine whether there is an election to include S corporation share of income by shareholders of the corporation, and Determine how dividends of the corporation and its shareholders are treated. If an S corporation is treated as a partnership for federal income tax purposes, Form 1120-S also requires information about the partnership's income, deductions, and credits. This information should be listed on Part III. If an S corporation is a personal service corporation (PSC) for federal income tax purposes, Form 1120-S also requires information about the corporation's income, deductions, and credits. This information should be listed on Part III. What if the information on the Schedule A is incorrect? If your Schedule A doesn't give the correct information, we will apply the following adjustments and provide notice of your corrections. If the corrected information doesn't affect the corporation's income tax, we'll include it in the return. If the amended information affects the corporation's federal tax liability, we'll apply either of the following: a) the modified adjusted gross income of the corporation, or b) the corporation's income amount on the Form 1120. If either of the adjustments above applies, no notice should be sent. Corrected return with income amount in effect Before we send a corrected return you must receive the following information. The following information must be found on the corrected return: Your corrected income tax return. Your corrected Form 1120-S. This item lists any adjustments that affect your income tax. You must have your corrected Form 1120-S if you haven't received it yet. The date the schedule is due. Any return received after that date but before the due date of the amended return may not be accepted. Corrected schedule Schedule A Corrected return without income amount on Form 1120-S Form 1120-S may be filed by completing the Form 1120. If a return is missing some or all of the information required on the form, or it's incorrect because of a typographical error, we may not fill the entire form. Therefore, our procedures for completing Schedule A depend on the return missing some or all of the required information. If we find that the return is missing any of the information on Schedule A, we won't make any of the adjustments listed on this form, even if the additional information required is on the

Award-winning PDF software